Why create a mortgage:

Included in the software is a mortgage module that allows for automatic calculation of your outstanding mortgage and allocates the principle and interest based on your accounting preferences either cash flow (mortgage+principle) or income (interest only).

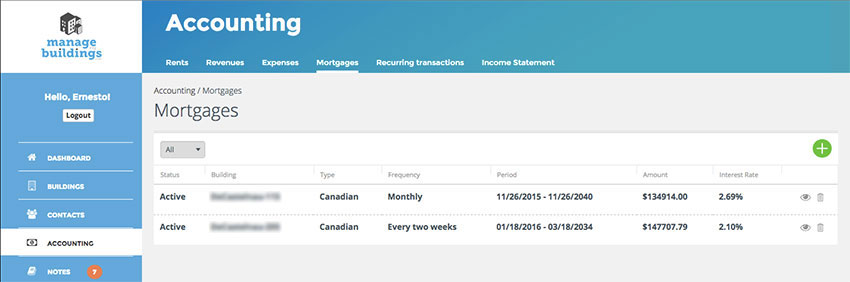

Main Screen:

The main screen will display any active mortgages, to view the transaction click on the eye button ![]() or click on the delete

or click on the delete ![]() button to stop the mortgage.

button to stop the mortgage.

How to create a mortgage:

Step 1

- Go to the mortgage screen click on the ACCOUNTING option on the main menu

- Click on MORTGAGES from the top menu

- Next click on the GREEN PLUS

icon at the top right of the screen:

icon at the top right of the screen:

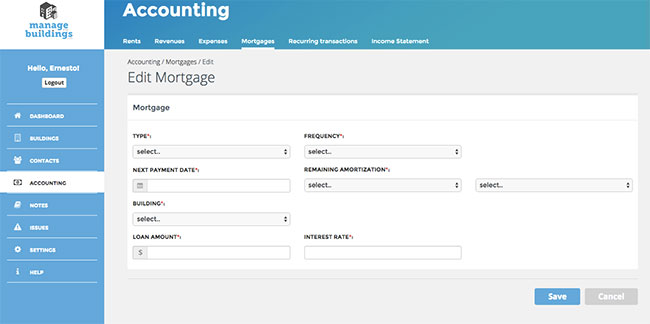

Step 2 – Enter the mortgage info:

- In the TYPE drop down based on your country choose either American (compound monthly) or Canadian (semi-annually). Note for European mortgages please choose American (compound monthly)

- In the FREQUENCY drop down you can choose your amortization period (e.g. monthly, bi-weekly, etc.)

- NEXT PAYMENT DATE: field used as a start date or next payment date (Note: this can be found via your bank website)

- REMAINING AMORTIZATION: used to calculate what is left for the mortgage amortization; choose from the two drop downs “YEAR” and “MONTH” (Note: this also can be found via your bank website)

- BUILDING: choose the building the mortgage is linked to

- LOAN AMOUNT: enter the remaining amount of the loan before the NEXT PAYMENT DATE

- INTEREST RATE: enter your current interest rate

How to manage your Mortgage:

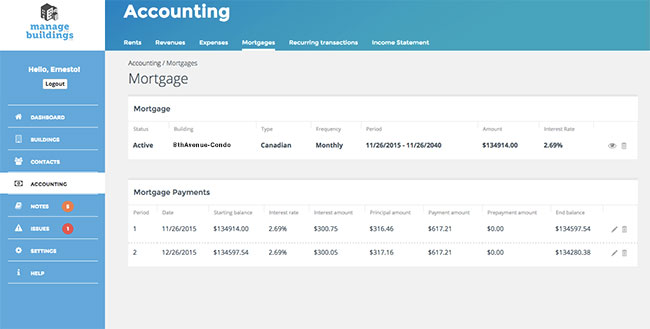

“Mortgage” View:

- VIEW

icon to view the details of the mortgage

icon to view the details of the mortgage - TRASH

icon will not delete the mortgage but make it inactive

icon will not delete the mortgage but make it inactive

“Mortgage Payments” View:

- EDIT

icon to edit the payments interest rate or pre-payment entry

icon to edit the payments interest rate or pre-payment entry - TRASH

icon will not delete the mortgage but make it inactive

icon will not delete the mortgage but make it inactive

Note: To reactivate the mortgage you will need to recreate a new mortgage.

Examples of why you would edit or delete payments:

Variable Mortgage rates increase

You have a variable interest mortgage and the rate increases. You would edit the rate for the period the interest rate increased and the future payments will recalculate based on the new interest rate.

Prepayment

You add a prepayment based on your yearly allowance you would enter the amount for the period the payment was completed and the mortgage will recalculate base on the remainder of the principle.

Why delete payments?

Because an inactive mortgage has active payment entries each entry has to be manually deleted. To delete the entry you can click on the TRASH ![]() icon next to the entry you wish to delete. Once the entry has been deleted the data will not appear in the income statement or financial reports.

icon next to the entry you wish to delete. Once the entry has been deleted the data will not appear in the income statement or financial reports.